Did you know that over $100 billion is transferred globally each year for education and healthcare purposes? Ensuring accurate beneficiary information is critical for seamless cross-border transactions. Axis Bank offers robust digital solutions to simplify this process.

With 24/7 accessibility through mobile and internet banking platforms, managing beneficiaries has never been easier. Whether you’re sending funds for education or medical needs, the bank ensures a hassle-free experience. Transactions are capped at $25,000 per transfer, aligning with RBI guidelines for NRE/NRO account holders.

Axis Bank’s secure and compliant processes make it a trusted choice for international payments. Accurate beneficiary details are essential to avoid delays or errors. The bank’s user-friendly platforms empower customers to manage their transactions efficiently.

Key Takeaways

- Axis Bank provides digital tools for managing cross-border transactions.

- Accurate beneficiary information ensures smooth international payments.

- 24/7 accessibility via mobile and internet banking platforms.

- Transaction limit of $25,000 for education and healthcare purposes.

- RBI-compliant processes for NRE/NRO account holders.

Why Updating Beneficiary Details is Important

Keeping beneficiary details up-to-date ensures smooth and secure fund transfers. Outdated information can lead to transaction rejections, especially if SWIFT or IBAN codes are incorrect. Regular updates help maintain compliance with FATF and RBI regulations, ensuring seamless cross-border payments.

For recurring payments, such as education or medical emergencies, accurate beneficiary data is essential. Transactions initiated before 4 PM IST often receive same-day clearance, reducing processing delays. Regular verification also protects against fraud, safeguarding your funds.

Overseas account holders benefit from updated details, enabling NRE repatriation and urgent transfers via the Instant Money Transfer (IMT) feature. Ensuring accurate information not only prevents delays but also guarantees that your funds reach the intended recipient without complications.

Prerequisites for Updating Beneficiary Details

Preparation is key when managing beneficiary information for global transfers. Before making any changes, ensure you have the necessary documents and access to the required platforms. This ensures a smooth and secure process.

Required Information and Documents

To update beneficiary details, you’ll need specific information. This includes the recipient’s full name, account number, and SWIFT or IBAN codes. Additionally, keep your registered mobile number handy for authentication purposes.

Access to Axis Bank Internet or Mobile Banking

Axis Bank offers multiple platforms for managing beneficiary details. You can use their internet banking portal or the mobile app for convenience. The axis mobile app provides biometric login options for iOS and Android devices, ensuring secure access.

Security is a top priority. The bank employs a dual authentication process, requiring both OTP and mPIN for high-value transactions. After changing security questions, a 5-day restriction is applied to enhance safety.

- Limit management via Services > My Profile > Limit Management.

- Cross-platform synchronization between the mobile app and web portal.

- Auto-logout features after 10 minutes of inactivity.

By following these prerequisites, you can ensure a seamless experience when updating beneficiary details. Accurate information and secure access are essential for successful transactions.

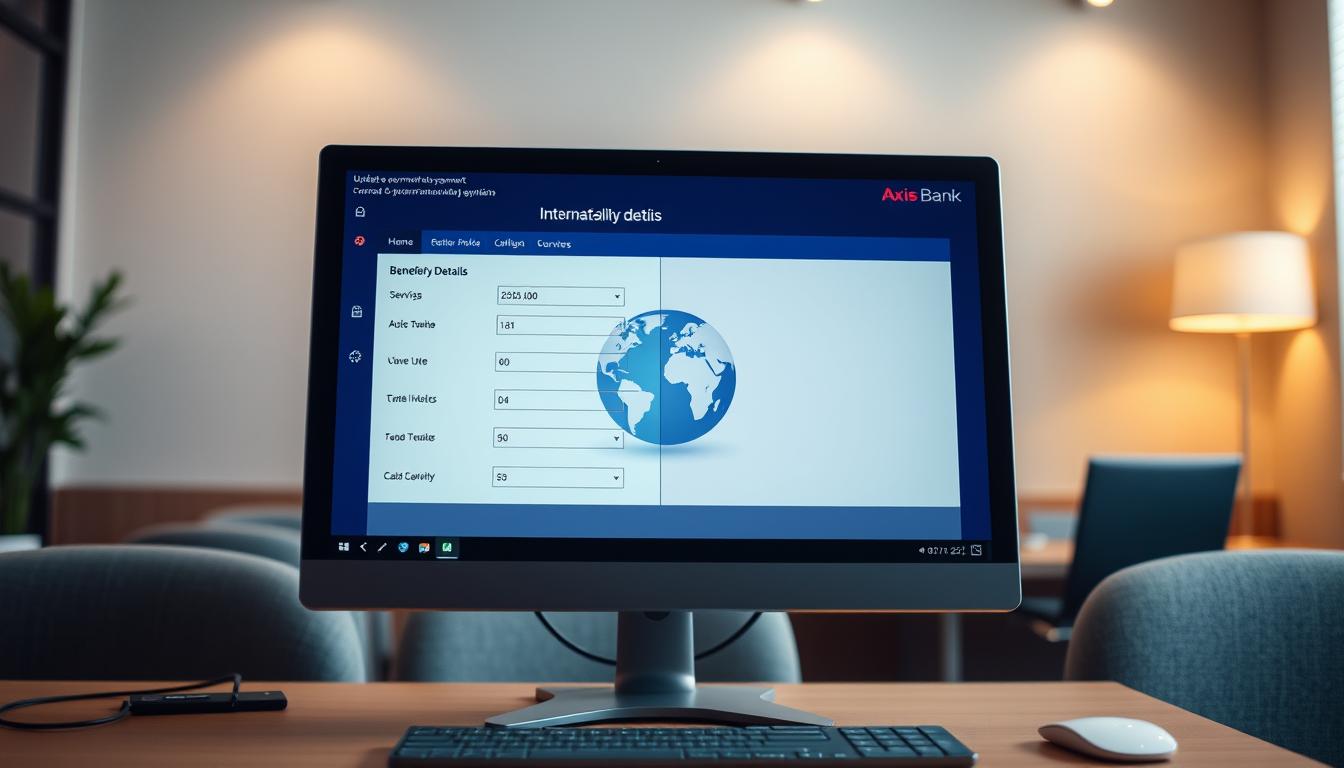

Step-by-Step Guide to Update Beneficiary Details

Efficiently handling global fund transfers involves a clear process. Axis Bank’s digital platforms simplify this task, ensuring accuracy and security. Below is a detailed guide to manage your recipient information seamlessly.

Logging into Axis Bank Internet Banking

Start by accessing the internet banking portal. Use your credentials to log in securely. For added safety, the system employs a dual authentication process, requiring both OTP and mPIN.

Navigating to the Beneficiary Management Section

Once logged in, locate the “Beneficiary Management” option under the “Services” tab. This section allows you to view, edit, or add new recipient details. The interface is intuitive, making navigation straightforward.

Editing or Adding New Beneficiary Details

To modify existing information, select the recipient and update the required fields. For new entries, input the recipient’s full name, account number, and SWIFT or IBAN codes. Double-check all details to avoid errors.

Verification and Confirmation

After making changes, the system will prompt you to confirm the updates. An OTP will be sent to your registered mobile number, valid for 5 minutes. Once verified, you’ll receive an SMS or email confirmation with a reference number.

- Time-bound OTP validity ensures security.

- Error handling for failed authentication attempts.

- Auto-sync with RBI’s payment tracking systems.

Common Challenges and Solutions

Managing global transactions can sometimes present unexpected hurdles. While digital platforms simplify the process, certain issues may arise. Understanding these challenges and their solutions ensures smoother fund transfers.

Issues with OTP or mPIN

OTP and mPIN authentication are critical for secure transactions. However, users may face delays if the OTP isn’t received promptly. A 30-minute cooling period is required after multiple failed attempts. Ensure your registered mobile number is active to avoid such disruptions.

Delays in Beneficiary Activation

Beneficiary activation may take time due to RBI-mandated verification timelines. For urgent transfers, priority processing is available. Track the progress using the transaction reference number provided. If delays persist, escalate the issue through the bank’s escalation matrix.

- RBI verification ensures compliance and security.

- Emergency transfers are prioritized for faster processing.

- Holiday schedules, such as Diwali or Christmas, may impact timelines.

- Visit your nearest branch for immediate assistance if needed.

By addressing these challenges proactively, you can ensure seamless and secure fund transfers. Staying informed about potential issues and their solutions enhances the overall experience.

Tools to Simplify International Payments

Streamlining global transactions requires the right tools and technology. Modern platforms offer advanced features to make send money abroad easier and more efficient. These tools ensure accuracy, speed, and compliance with regulatory standards.

One of the standout features is the integrated currency converter, which uses live Reuters rates. This ensures you get the best forex rates for your transactions. Additionally, bulk payment templates simplify recurring transfers, saving time and effort.

Automation plays a key role in simplifying compliance checks. AI-driven systems verify details to ensure adherence to global regulations. Some third-party platforms, like Karbon FX, offer competitive rates and seamless integration for multi-currency transactions.

- Auto-detect feature identifies intermediary bank requirements, reducing errors.

- API integration with accounting software streamlines financial management.

- Real-time tracking ensures transparency throughout the payment process.

These tools not only enhance efficiency but also provide peace of mind. Whether you’re managing personal or business transactions, leveraging these features ensures a smooth and secure experience.

Best Practices for Managing Beneficiary Details

Effective management of recipient information is crucial for seamless transactions. Regular reviews and precise data ensure smooth fund transfers. These practices minimize errors and enhance efficiency.

Regularly Reviewing and Updating Information

Frequent checks help maintain compliance with regulatory standards. Cross-verification through bank statement PDFs ensures data consistency. Dual-entry confirmation for critical fields reduces the risk of errors.

Automated workflows, such as beneficiary confirmation emails, streamline the process. For corporate clients, ISO 20022 XML validation ensures adherence to global standards. Error logging identifies and resolves failed validation attempts promptly.

Ensuring Accuracy in Details

Precision in recipient data is essential for successful transfers. Verify the account number and bank name to avoid delays. Accurate details ensure funds reach the intended recipient without complications.

Using live Reuters rates for currency conversion enhances accuracy. Real-time tracking provides transparency throughout the transfer process. These measures safeguard against fraud and ensure compliance.

- Cross-verification through bank statement PDFs.

- Dual-entry confirmation for critical fields.

- Beneficiary confirmation email workflows.

- ISO 20022 XML validation for corporate clients.

- Error logging for failed validation attempts.

Conclusion

Managing cross-border transactions effectively requires attention to detail and secure processes. Axis Bank’s 7-step verification ensures accuracy and compliance, minimizing errors and delays. Their digital-first approach offers 24/7 accessibility, making fund transfers convenient and efficient.

Customers should remember the $25,000 transaction limit for education and healthcare purposes. For enhanced security, manage your mPIN carefully and avoid sharing it with others. These practices safeguard your transactions and ensure seamless international payments.

Looking ahead, Axis Bank is exploring blockchain-based solutions for beneficiary verification. This innovation promises faster, more secure processes, further enhancing the customer experience. Stay informed and leverage these advancements for smoother global transactions.